Economic

KPS Berhad recognises the importance of maintaining strong financial and business performance in advancing the ESG agenda.

Our Commitment

Driving optimum business and operational performance towards maximising financial and non-financial value creation

Indirect Economic Values

2022RM’000 |

2023RM’000 |

2024RM’000 | |

|---|---|---|---|

| Economic Value Generated | 1,557,760 | 1,308,423 | 1,200,954 |

| Economic Value Distributed | 1,354,067 | 1,529,278 | 1,149,300 |

| Operating Cost | 1,022,536 | 1,165,890 | 821,857 |

| Community Investment | 1,822 | 2,779 | 1,774 |

| Total Payout to Employees in Salaries and Benefits | 252,727 | 252,280 | 233,841 |

| Finance Costs (Repayment to Financiers) | 24,139 | 22,664 | 18,626 |

| Corporate Taxation and Zakat | 24,039 | 32,503 | 33,543 |

| Dividend Returns to Shareholders | 28,804 | 53,162 | 37,382 |

Group Procurement Data

2022 |

2023 |

2024 | |

|---|---|---|---|

| Total Procurement Spending (RM) | 353,591,658 | 462,444,736 | 523,023,166 |

| Proportion of Spending on Local Suppliers (%) | 78 | 69 | 71 |

| Percentage of Local Suppliers (%) | 79 | 85 | 81 |

| Number of Suppliers Endorsed Anti-Bribery/ Anti-Corruption Policies (third party declaration) |

NA | 825 | 785 |

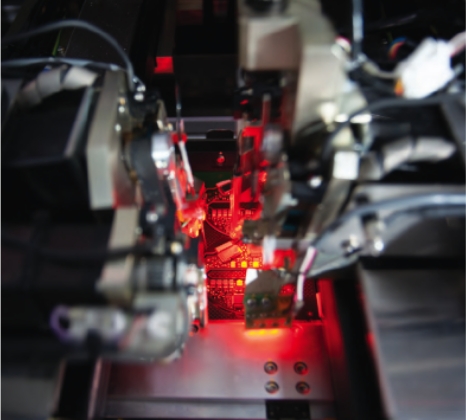

Stringent Quality Control Procedures

KPS Berhad remains steadfast in its commitment to prioritising the quality of its products and services. The production of items and services that fulfil their intended purposes and positively impact stakeholders is a fundamental principle in the Group’s value creation strategy. Ensuring and enhancing product and service quality, to achieve exceptional customer satisfaction, are non-negotiable imperatives for the Group.